Despite recent concerns, economic growth is poised to accelerate in 2026

Review the latest Weekly Headings by CIO Larry Adam.

Key takeaways

- Despite recent concerns, economic growth is set to accelerate in 2026

- Market broadening has been led by some “unloved” sectors

- Improving fundamentals have supported emerging market equities

Markets move through phases of resilience, shifting leadership and renewed opportunity. We’ve seen this play out in recent months as performance has broadened beyond mega‑cap tech into areas that had long been overlooked. Below, we outline some of the key shifts shaping today’s economy and financial markets and share our perspective on how these trends may continue to evolve in the months ahead.

Economic signals

January job growth surprised to the upside, with 130,000 jobs added, the strongest monthly gain in more than a year. However, after revisions, 2025 marked the slowest non‑recessionary pace of job growth since 2003 as job openings fell to a five‑year low and the Employment Cost Index slowed to its weakest pace since mid‑2021. Consumer signals softened as well: December retail sales were flat, and credit‑card delinquencies rose to their highest level since early 2011, raising questions about the economy’s trajectory.

Our view: Demographic and immigration trends suggest the economy now needs fewer new jobs to stay in balance – roughly 75,000 per month by our estimate. Even so, several indicators point to a near‑term pickup from the recent softer pace. Consistent with January’s improvement in the ISM Manufacturing Index, cyclical areas are beginning to stabilize. Manufacturing added jobs for the first time in 14 months. A firmer labor backdrop, alongside resilient credit‑card spending, healthy leisure demand, rising household net worth and larger tax refunds, supports our view that consumer spending will remain resilient and economic growth will accelerate to 2.4% in 2026.

Market broadening

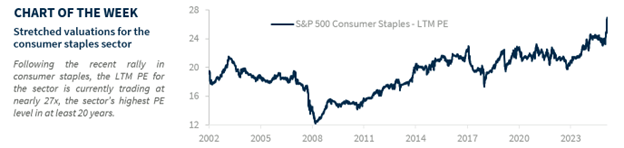

The S&P 500 Equal Weight Index hit its 13th record high YTD this week and is outperforming the cap-weighted index by 4.9%, its widest gap since 1992. Notably, some of the market’s most overlooked sectors have led the way. Energy and consumer staples are among the top‑performing sectors YTD, with both reaching all-time highs. Small caps have also come out strong, posting their best start to a year since 2021. In contrast, the tech‑heavy NASDAQ is ~6% below recent highs, highlighting the ongoing rotation happening beneath the surface.

Our view: With some sectors now looking stretched, we are cautious that the recent outperformance may prove temporary. Consumer staples now trade at their highest valuation since 2000. Small‑cap earnings estimates, after rising sharply, are beginning to roll over just as valuations sit at their widest premium to large caps in five years. Instead, we favor select cyclical areas where earnings visibility remains strong. Continued investment in AI should support both technology and industrials, and despite recent underperformance, tech earnings’ estimates have been revised ~10% higher over the past three months. Meanwhile, resilient consumer trends point to a potential rotation from staples back toward consumer discretionary. Sector selectivity and a focus on fundamentals remain key.

Emerging markets

Emerging market equities are among the top‑performing regions YTD, up ~12% in USD terms, and handily outpacing both US stocks and other developed markets. That strength has many investors asking whether the rally still has room to run.

Our view: Investors have long approached emerging markets with caution, citing uneven fundamentals, political risk and higher volatility. But we think the asset class deserves a fresh look, especially given how under‑allocated many investors remain. While recent performance has been strong, the gains are increasingly supported by improving fundamentals. Earnings revisions have picked up meaningfully this year, rising 10% year to date, led by markets such as Korea and Taiwan that continue to benefit from the global AI trend. And while emerging market performance has historically been closely tied to China – the largest weight in the index – leadership has broadened across other key emerging economies. We expect that diversification to continue, helping create a more durable foundation for emerging market returns going forward.

Energy sector

Rising geopolitical tensions, especially between the US and Iran, have put a risk premium back into energy markets, driving oil prices toward $65 a barrel. Alongside the broader rotation away from mega‑cap tech, this has renewed investor interest in energy stocks, pushing the S&P 500 Energy sector (+21% YTD) into the ranks of this year’s top performers.

Our view: While fears of supply disruptions have lifted oil prices, we don’t expect these levels to last. Historically, once geopolitical tensions ease, the added risk premium tends to fade. With global supply projected to exceed demand for a sixth straight year, we expect oil prices to drift lower, ending the year closer to the $55-$60 range. And despite the recent rally in energy stocks, the sector has seen the steepest earnings downgrades in late 2025. That reinforces our view that an underweight position in energy remains appropriate.

*MAGMAN represents a composite of Microsoft, Apple, Google, Meta, Amazon, Nvidia. The foregoing is not a recommendation to buy or sell MAGMAN stocks.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success.

Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.

The S&P 500 Total Return Index: The index is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 7.8 trillion benchmarked to the index, with index assets comprising approximately USD 2.2 trillion of this total. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization.